Welcome to Payoneer!

Let’s get your business started for boundless growth

Congratulations on opening your Payoneer account!

Payoneer is happy to become your overseas business payment partner. We truly believe in our vision of borderless payments for your boundless business growth!

As a new Account holder, there are a couple of things that you must know to have a smooth onboarding experience.

- In order to use your account smoothly, you must fulfill all verification requirements. Don’t worry we will guide you through the process

- Learn about all our services and products to be fully clear on what is the right service for you and your needs. Payoneer products are geared for SMBs receiving overseas payments and also supports payments from marketplaces like Fiverr, Upwork etc. for freelancers and Amazon, eBay etc. for online sellers with active stores

Avoid these actions that cause account closure

Before you begin, here are some actions that are not permitted at Payoneer. Doing any of the below may result in account closure.

- Do not buy or sell dollars or any other currency on the platform. If you currently do not have any source of earning that you can receive in your account, then we suggest you close your account by contacting customer support and create a new one when you are ready

- Make sure you go through list of prohibited Line of Businesses to avoid any unfortunate violation later. Here is the full list of prohibited Line of businesses: https://www.payoneer.com/legal/restricted-businesses/

- You currently do not have any source of overseas earning that you will receive in next 2 months. We suggest you close your account by contacting customer support and come back when you are ready. Keeping an inactive account can lead to complications later

- Your business is such where you are not regularly documenting your transactions via an official email ID and invoice. It is absolutely critical to document all your.

For more info refer to this video:

- Do not buy or sell dollars or any other currency on the platform. If you currently do not have any source of earning that you can receive in your account, then we suggest you close your account by contacting customer support and create a new one when you are ready

- Make sure you go through list of prohibited Line of Businesses to avoid any unfortunate violation later. Here is the full list of prohibited Line of businesses: https://www.payoneer.com/legal/restricted-businesses/

- You currently do not have any source of overseas earning that you will receive in next 2 months. We suggest you close your account by contacting customer support and come back when you are ready. Keeping an inactive account can lead to complications later

- Your business is such where you are not regularly documenting your transactions via an official email ID and invoice. It is absolutely critical to document all your. For more info refer to this video:

Let’s get you verified!

There are two types of accounts and verification varies based on these accounts

- Individual Account

This is the standard account that you create with your own personal individual details - Company Account

This is the account you create based on company information as an authorized representative

Verification for individuals

Personal ID

We recommend submitting your national ID card. For full list of acceptable documents, scroll to the bottom> Select Pakistan from country list and view acceptable documents here: https://payoneer.custhelp.com/app/answers/detail/a_id/43071

You can submit any of the following:

- National ID Card

- Valid and unexpired Passport

- Driving License

Proof of residence

We recommend using official Bank statements (not older than 3 months) which clearly show the address and your name and date of issue on it. The Name and address on the bank statement MUST be the same as shared with Payoneer

For full list of acceptable documents of proof of residence, please visit the page: https://payoneer.custhelp.com/app/answers/detail/a_id/43154

Scroll down>select Pakistan as country and view all examples of acceptable documents

Bank verification documents

We recommend using official Bank statements (not older than 3 months) which clearly shows the address, name, bank account number, IBAN/SWIFT (if available), branch address, bank name and any other relevant information.

You may also submit an image of a void check. For full list of acceptable documents, please visit: https://payoneer.custhelp.com/app/answers/detail/a_id/43155

Scroll down> Select Pakistan as country> View all examples of acceptable documents

A picture of YOU!

Please follow the page for more info: https://payoneer.custhelp.com/app/answers/detail/a_id/43093

That’s it. You are all set!

After successful submission of all documents, we recommend waiting for at least 7 working days for approval. If even after 7 working days, your documents are not approved, only then you may contact customer support. If you contact before passing of 7 working days, your query will not be served as it is within our stated time limit.

Live chat and email message:

https://payoneer.custhelp.com/app/chat/chat_launch

https://payoneer.custhelp.com/app/ask

Verification for companies

Company verification documents

We recommend submitting a company incorporation certificate from SECP the most. For full list of acceptable documents, please visit: https://payoneer.custhelp.com/app/answers/detail/a_id/43127

Scroll down> Select Pakistan> View all examples of acceptable documents

Proof of company address

We recommend submitting Company Bank account statement (not older than 3 months) where name of the company and address is mentioned clearly. The Company name and address must match as provided to Payoneer. For full list of acceptable documents, please visit:

https://payoneer.custhelp.com/app/answers/detail/a_id/43157

Scroll down> Select Pakistan> View all examples of acceptable documents

Authorized representative letter

We recommend a letter on company letterhead clearly stating that you are the authorized representative with your stated NIC and designation at company. The letter must also be signed by CEO/Managing Director of the company ideally with a company stamp. You can scan the document and upload it as a PDF.

For more info on this, please visit: https://payoneer.custhelp.com/app/answers/detail/a_id/43094

That’s it. You are all set to grow your business!

After successful submission of all documents, we recommend waiting for at least 7 working days for approval. If even after 7 working days, your documents are not approved, only then you may contact customer support. If you contact before passing of 7 working days, your query will not be served as it is within our stated time limit.

Live chat and email message:

https://payoneer.custhelp.com/app/chat/chat_launch

https://payoneer.custhelp.com/app/ask

Finding the right product for you!

If you have direct clients overseas then we offer the following suite of services:

- Request a Payment link

Simply send a link to your client and they can choose to pay you via credit card, bank transfer or e-check. If your client is paying from an individual bank account, then this service is ideal for you. For more info, see the video below:Request a Payment link

Simply send a link to your client and they can choose to pay you via credit card, bank transfer or e-check. If your client is paying from an individual bank account, then this service is ideal for you. For more info, see the video below:

- Wire Transfers This service is limited and only available to customers with high monthly volume in USD. Sales team will help high value customers with enabling this option.

You need to have a Company Payoneer Account with USD 5,000 above monthly volume.

If you do not have direct clients and are looking to receive payments from Marketplaces, then follow the steps below for each marketplace: - Freelancer Marketplace

– For Fiverr, please visit: https://www.payoneer.com/solutions/marketplaces-networks/fiverr-payout/

– For Upwork, please visit: https://blog.payoneer.com/how-to/get-paid/how-to-add-multiple-partners-to-one-payoneer-account/

– Any other freelance marketplace, please visit: https://blog.payoneer.com/how-to/get-paid/how-to-add-multiple-partners-to-one-payoneer-account - Seller Marketplace

a. For Amazon, you will be creating a USD local receiving account and connecting that with your Amazon account. For more info, please visit: https://payoneer.custhelp.com/app/answers/detail/a_id/18780/kw/amazon

b. For eBay, please visit: https://payoneer.custhelp.com/app/answers/detail/a_id/36112/kw/ebay

How do I take out money from Payoneer?

Now that you are all set, the last step is to see how to withdraw your money from Payoneer

If your monthly volume is below USD 100, you can use Jazz Cash to withdraw funds from Payoneer. Simply open you Jazz Cash app and connect your Payoneer account to Jazz Cash app. Do not add Jazz Cash as a withdrawal bank from Payoneer.

For more info: https://blog.payoneer.com/how-to/get-paid/jazzcash-payoneer-freelance-payments/

If your monthly volume is above USD 100, you can use any of the following methods:

Faysal Bank

Connect your Payoneer account with Faysal Bank Digi mobile app. Minimum amount that can be withdrawn is USD 100. For more info: https://blog.payoneer.com/news/payoneer-partners-faysal-bank/

HBL

Connect your Payoneer account with HBL mobile app. Minimum amount that can be withdrawn is USD 100. For more info: https://blog.payoneer.com/news/payoneer-partners-with-hbl-bank-to-enable-real-time-withdrawals-for-pakistani-customers/

Jazz Cash

You can receive up to PKR 500,000 per month and up to PKR 150,000 per day. The minimum withdrawal limit is only USD 5. This makes it suitable for regular freelancers to receive payments

Any other bank in Pakistan

Simply add your bank details. Minimum amount that can be withdrawn is USD 150

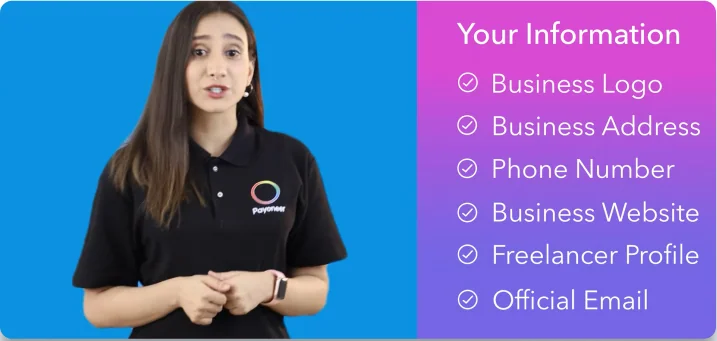

Business Questionnaires

When you opt for either Request a Payment link service or local receiving accounts in 9+ currencies (Global payment service), you will be required to submit a business questionnaire. See samples below for a smooth verification process. Provide as much information about your business or services/products as possible.

- To receive funds from marketplaces

This includes freelancer and seller marketplaces. - To receive payments from customers

If you have direct business customers to whom you provided services or products - To pay suppliers

To pay suppliers, freelancers, contractor from the payments received first - To accept credit/debit card payments

If your business customer wants to pay you via credit card - To consolidate and manage currencies

If you receive payments in multiple currencies & want to exchange between them - What is your DBA (doing business as) name?

Mention your official name or business name that will be on your invoices, email ID or any official document - Tell us a bit about how your business operates

Is it a registered business, what services do you provide, where are your clients based etc.

More verifications

See the video below to learn how to document your business transactions

When will I receive my payments?

See the video below to learn about our stated timelines. Once these timelines have passed, you may contact customer support. If you contact support prior to the stated timeline, your query will not be lodged.

Live chat and email message:

https://payoneer.custhelp.com/app/chat/chat_launch

https://payoneer.custhelp.com/app/ask

How do I use my funds in Payoneer?

- You can withdraw them to your bank account or mobile wallet like Jazz Cash

- Use funds via Payoneer card. You can apply for the card from your Payoneer account and submit proof of residence (explained above). You can use the card for online shopping or POS or ATM. For more info, please visit: https://www.payoneer.com/solutions/payoneer-commercial-card/

- Use your funds to pay contractors, vendors and suppliers by clicking on Pay> Choose the relevant method (please note: only business payments can be made. This means, only payments against delivery of service or product. The payment can be outside of Payoneer network into a bank account or Payoneer to Payoneer)

Related resources

Latest articles

-

Planning to hire employees in Germany? Here’s a quick guide

Looking to hire employees in Japan for your U.S. company? Learn about hiring practices in Japan and how Payoneer Workforce Management makes it easy to hire in Japan.

-

Planning to hire employees in the Philippines? Here’s a quick guide

Wondering how an American company hires employees in the Philippines? Our guide covers how to hire employees in the Philippines and how we can help.

-

Planning to hire employees in Japan? Here’s a quick guide

Looking to hire employees in Japan for your U.S. company? Learn about hiring practices in Japan and how Payoneer Workforce Management makes it easy to hire in Japan.

-

Planning to hire in Hong Kong? Here’s a quick guide

Are you hiring employees in Hong Kong for your U.S. company? Learn about employment in Hong Kong and how Payoneer Workforce Management makes it easy to hire in Hong Kong.

-

Planning to hire in Colombia? Here’s a quick guide

Looking to hire employees in Colombia for your U.S. company? Learn about employment in Colombia and how Payoneer Workforce Management makes it easy to hire in Colombia.

-

Planning to hire employees in Brazil? Here’s a quick guide

Looking to hire employees in Brazil for your U.S. company? Learn about employment in Brazil and how Payoneer Workforce Management helps hire in Brazil.