Online Banking: what it is, how it works and best options

This guide was created to help you confidently navigate the basics of internet banking. Expect to learn answers to questions such as: What is online banking and how does online banking work? We also run through safety measures for transacting online.

Introduction

Online banking has revolutionized how businesses and freelancers manage their finances.

Over time, internet banking services have greatly improved banking access and efficiency. In a matter of clicks, you can check your bank balance, pay bills, transfer money, and even invest, right from your mobile device.

All you need is a bank account and a web connection on a computer. Alternatively, the connection might be on a mobile device that is connected to a wireless carrier.

In some cases, a mobile device is not even needed. For instance, smartwatches support contactless payments, such as Apple Pay on Apple watches and Google Pay on Samsung Galaxy watches.

Apart from traditional financial institutions that have brought their services online, other specialized payment service providers have appeared. These aim to expand banking abilities further and fill in the gaps left by traditional outfits.

This is because both business and individual users find regular online banking services still need to catch up in the global marketplace. We might see this in limited and regulated services offered by traditional outfits, especially across borders. What specialized payment service providers do is bring help, control, and a level of security to borderless online transacting.

In an internal Payoneer survey, our experts suggested the most important purpose of online banking is to provide a safe global platform to transact and save money.

What is online banking?

Also known as virtual, internet, web, electronic, or ebanking, online banking is a method of banking that allows registered users to access their bank accounts or monetary balances through the internet. You can access your funds through your bank’s website, desktop, or mobile app.

In some cases, you can get limited business banking functionality from personal devices such as your Apple watch or a Samsung Galaxy watch. This is useful for freelancers or entrepreneurs who need a banking solution on the go.

Some common online banking examples include:

- Moving funds from one account to another through a bank’s site

- Checking account balance and statements through a bank app

- Depositing a check through a mobile banking app

Traditional banks aren’t the only digital banking providers. Platforms like Payoneer offer some of the most convenient global payment service options that enable businesses to transact online.

In particular, they provide the best online payment service options to process and control transactions without depending on banks. They typically do this at a fraction of the cost and time associated with traditional methods.

Regardless of who you bank with, online banking allows you to log into your bank accounts and access many (if not all) of your banking services from any location at any time. It is hassle-free. You can transact and do the same actions from the comfort of your home or office. It is no longer required to meet with your banker or visit a physical branch or ATM to perform standard banking services.

Important services that online banks provide to businesses

Nearly all banking services that traditional banks provide are available through online banking, including:

- Funds transfers and deposits

- Bill payments

- Verify account transactions and balances

- Deposit checks remotely

- Loan applications

There are additional services you can access through online banking platforms but won’t get via local bank branches. A few of these include:

- Budgeting and tracking tools

- Instant online applications and approvals

- Cardless ATM withdrawals

- AI-driven banking insights and recommendations

- Wallet service to upload or receive funds into an account without a merchant account

- Extended customer service hours with 24/7 online chat availability

Now, let’s take a look at the important services that online banks provide to businesses in more detail:

Funds transfer

The basic premise of an online banking transfer is to move money from one account to another. This could be local or cross-border. It could also be internally between the business’s accounts or externally to third parties.

In the bigger picture, funds transfers take many forms and are known by different names, depending on the country you are in. Some common types include:

- ACH payments (U.S.)

- Direct Debits (U.K.)

- SEPA payments (E.U.)

- NEFT (India)

- RITS (Australia)

- PhilPaSS (Philippines)

Bill payments

Online banking offers a simple way to pay your bills, for example, your rent, cable, or electricity accounts.

These could be business or personal, and even once-off or recurring payments. For the latter, automating payments by agreeing to a debit order is often possible.

Settling your bills via online banking is extremely convenient. Many institutions enable you to select the provider to pay, then pay using your account number as a reference. There is no need to set up beneficiaries or send cash or checks.

Often, the institution promises instant funds clearance, so you can settle bills on the day they are due.

Verify account transactions and balances

Online banking makes it easy to review account transactions and check your account balance in real-time. You can also access your transaction history and account statements whenever needed.

For larger businesses or those that deal with mass transactions, online banking integrations with accounting platforms, such as QuickBooks, simplify the process. They do this by pulling data into the accounting platform, where you can automatically sort and enter transactions into your cash book.

Expert tip: Your online transaction history may be limited to one year. Most businesses need to keep records longer than that. It is recommended to download monthly statements and save a backup.

Deposit checks remotely

Some banks allow you to deposit checks remotely without stepping into a branch.

All you have to do is take a clear photo of the check (front and back side). Then, submit it through your bank’s mobile banking app. The balance will reflect as soon as your bank verifies the deposit from the payer.

Note that the confirmation can take up to three days to clear. So, it is by no means an instant payment method.

Budgeting and tracking tools

As part of the online banking experience, your financial services provider may give you access to built-in budgeting and tracking tools.

These tools support real-time expense tracking, customizable budgeting features, detailed financial reports, and accounting software integration. Use them to optimize your financial management and improve your business’s bottom line.

Instant online applications and approvals

Financial institutions hold your KYC information. Because of this, many provide a quick and convenient way to apply for and receive approval for their financial services and products.

The process is completed online, often with instant approval. This way, you can quickly access products such as credit cards, loans, and lines of credit to grow your business.

Cardless ATM withdrawals

Businesses can process cardless ATM withdrawals through online banking features. The process is initiated through the banking dashboard and requires a one-time pin at the ATM. This provides a secure and convenient way to transact.

AI-driven insights and recommendations

Some banks use AI algorithms to provide businesses with financial insights and recommendations based on data analysis.

You can receive reports on how to optimize cash flow, manage expenses, and improve your business profitability.

AI can also perform predictive analysis of your business’s potential risks and opportunities.

With this information, you can make informed financial decisions and work smarter toward long-term goals.

Wallet service for banking without a Merchant Account

A wallet service allows you to upload or receive funds into an account through a bank transfer, credit or debit card, and so on. This means you can transact online without a merchant bank account. It gives you freedom to move money internationally with greater ease.

Extended customer service hours

Website chatbots extend customer service hours beyond regular business banking hours. Unlike human customer service representatives, chatbots can be available 24/7 to assist customers with their queries and concerns.

Chatbots can also handle multiple customer inquiries at the same time, making it a more efficient way to handle customer service requests.

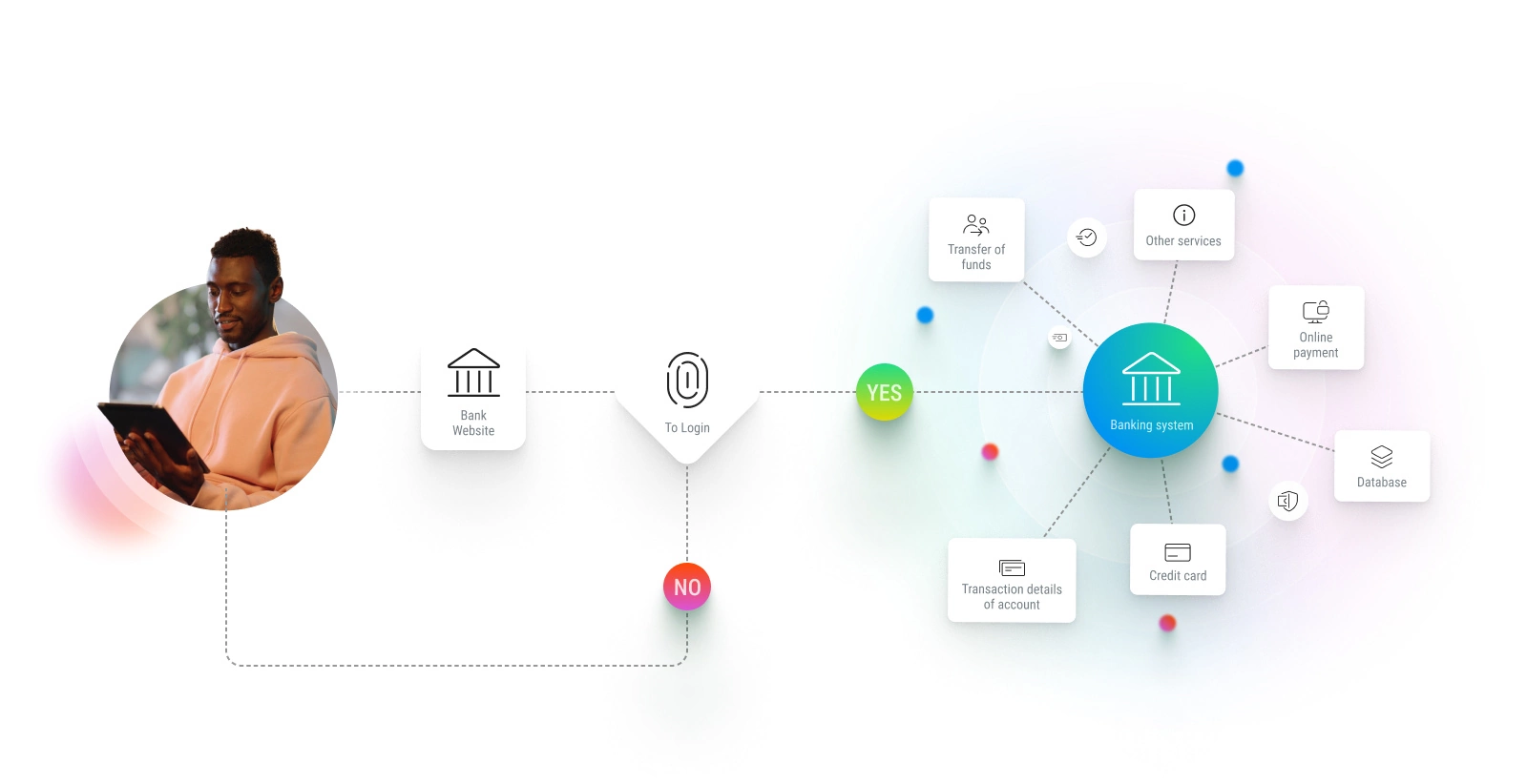

How does online banking work?

Online banking works through a banking system that connects your bank account to a secure website, or online banking web or mobile app.

You register as a user and create a unique username and password to gain access to your accounts, which the bank links to your profile. You will also need to fill out the necessary KYC (Know Your Customer) forms and provide the required documents (including your ID and proof of address). This allows banks to verify your identity.

In most cases, you need an active local debit card to transact.

After logging in, you can view your account information and perform various financial transactions and B2B payments. While doing this, the website or app provides various built-in security measures to protect your account from unauthorized access.

Here is a simple illustration of how the entire process works:

Advantages of online banking

Some of the main advantages of online banking include:

Convenience

Online banking for business is incredibly convenient and easy to use. You can transact from any location provided you are connected to the internet.

With online banking, there is no need to visit a physical branch or ATM to perform actions such as:

- Deposit checks

- Process local or international transactions

- Open checking, savings, or other accounts

- Maintain account balances in different currencies on different platforms

- Request transaction statements

This makes it easier to operate a business and sell your products or services with less red tape.

Level of security

When comparing the level of security of online banking vs. traditional banking, each has its benefits and challenges. However, digital security is constantly evolving and provided you take the proper safety measures, you can generally transact safely.

With online business banking:

- There is no need to worry about being targeted for carrying cash

- You can transact online with a bigger market in higher volumes

- Your checks won’t go missing in the mail

- It is more complex to forge your signature

- Rest easy with PCI-compliant processes that securely relay sensitive account information without storing it.

- Add security layers to transactions, for example, through online banking with virtual card details for single payments.

- Activate security alerts and get notified in real-time about activities in your account.

Speed

Time is money, and efficiency and control are the keys to success. Online banking allows you to complete transactions quickly and easily without waiting in line or filling out paperwork.

With immediate access to the bulk of your banking services, you can transfer money between accounts in a matter of seconds with instant payment processing. It’s easier to manage your finances on the go without worrying about delays or money clearing.

Lower fees

Online banking rates are typically lower than going into a brick-and-mortar branch and consulting with a teller.

This is because the bank saves on its overheads when you transact online. In turn, it often passes these savings to you, the user, through lowered fees.

Some of the fees that are usually lower in online banks include:

- ATM usage

- Overdrafts – you might receive a waiver or discount

- Check printing

- Paper statements

- Application processing charges for certain financial products like credit cards or loans

Disadvantages of online banking

Although online banking is fast and convenient, there are a few disadvantages to consider:

Technical issues

The system depends entirely on technology and the internet, which can be prone to the odd technical issues.

As few and far between as this occurs, should the website or mobile banking app go down, you won’t be able to access your accounts or perform any transactions. When this happens, it can be frustrating and time-consuming to deal with.

Digital banking also presents a challenge to those who are resistant to adopting new technology.

Limited services

Some brick-and-mortar banks limit the services they offer through their online banking platforms. Or they might impose transaction limitations to curb the potential for fraud.

For instance, some banks don’t offer certain services like check cashing or loan applications (especially long-term business capital) online. You may need to visit a physical branch to take advantage of these services.

Naturally, this applies more to traditional banks with an online component. Payment service providers typically operate fully online, selling their entire suite of online payment services.

Lack of personal interaction

Another disadvantage of online banking is the lack of personal interaction.

Most of the time, help is available by sending a message via online chat, email, or calling directly. But, it might be up to 24 hours before receiving personalized assistance.

As a result, getting the assistance you need when dealing with complex financial matters may be challenging.

Security risks

Online banking platforms implement several security measures that meet PCI standards to ensure your accounts are safe and secure. But these do not eliminate all the potential security risks of banking on the internet.

The reality is that you may be prone to cyberattacks like identity theft, phishing, and malware attacks. However, it’s essential to note that 95% of these cyber security attacks happen because of human error.

Most banking platforms are safe. You potentially expose yourself to cyber security breaches when you fail to take the necessary precautions to protect your account.

How to keep online banking information safe

All along, we have been talking about the importance of banking securely. Here are some tips for staying safe and protecting your privacy while transacting online:

Use a strong password

Passwords are potential weak points that criminals can exploit. To create a strong password:

- Use a mix of uppercase and lowercase letters, numbers, and special characters

- Avoid personal information and common words

- Assign unique passwords to each account

- Set your password to be at least 12 characters long

- Avoid password hints that are easy to guess

- Consider using a passphrase or series of unrelated words

- Regularly update passwords

Use two-factor authentication

Two-factor authentication makes it difficult for someone to hack into your account, even if they manage to get your correct login credentials.

This is because they must undergo a second security test after keying in the username and password. Enable 2FA for an additional layer of security to protect your account.

Also known as multi-factor authentication, two-factor authentication varies from bank to bank. It could be a code sent to your phone, SSD interaction, automated phone call, or biometric verification.

Monitor your accounts regularly

Check your accounts regularly for suspicious activities and report anything unusual right away.

Remember to activate automatic transaction notifications to get alerts on account transactions. This will make it easier to monitor your account in real-time and take quick action.

Be wary of phishing scams

Phishing is a common technique identity thieves use to get unsuspecting users’ personal and financial information.

Phishing scams take different forms but usually include an email or text message tricking you into providing your login credentials.

You might receive an email that appears to come from your bank asking you to log in and update your account information.

Be wary of such emails or texts because clicking on any links might allow identity thieves to access your account.

Also, be on the lookout for websites that ask for your personal information seemingly out of context, as they may be part of a phishing scam.

A solution for simpler, cross-border online banking

Online banking provides a convenient way to manage your business finances. However, in comparison, traditional outfits may have limited capabilities in the global marketplace.

Payoneer and other similar global payment service providers enable businesses, freelancers, entrepreneurs, and individuals to operate efficiently in the global economy with flexible payment solutions.

With these services, it doesn’t matter whether you are in the U.S. or the U.K. You can transact in multiple currencies internationally and access your funds locally. That is, through your local bank and in your local currency.

From a financial management perspective, the platforms offer tools and features to give deep insights into business performance. You can track transaction data, funds balances, and payment history. It’s also possible to pay bills and automate payments while transacting securely with world-class safety measures to protect your hard-earned income.

For those that need a solution to operate internationally, reduce fees, and lower transaction processing times, these services are your answer.

Frequently asked questions:

What types of transactions can I perform with online banking?

Most online banking platforms provide essential banking services, including:

- Viewing account balances and transaction history

- Transferring funds between accounts

- Paying bills

- Online payment request functionality

- Contactless payments with your Google, Apple or Samsung watch

- and more

Do I need special software to use online banking?

No, you don’t. Most banks will give you direct access to online banking services through their website or mobile banking application.

You can then use your web browser on your computer to access online banking services. Or download the app to perform various transactions within their mobile banking options.

That said, installing anti-virus or malware software on your access device is highly recommended. You will also need to be connected to a wireless carrier or wifi to access services on your mobile device.

Is there a fee for using online banking?

Yes, there is, although it varies depending on the online banking platform.

Some platforms may charge fees on a user basis and bill you for the online transactions or features you access.

Others might charge a blanket fee that covers your typical monthly transactions in full.

There are also some instances where several banking services are free, provided you have specific existing products with the bank or financial institution.

How do I sign up for online banking?

Visit the website of your bank or financial institution.

Find the sign-up or registration page and follow the prompts to create your account.

For most banks and institutions, you will need to enter your personal information, including your:

- Name

- Address

- Account number or debit card details

- Relevant documents to prove your identity (e.g. your ID card or passport and proof of address)

What is the best online banking app?

The answer depends on your specific banking needs, although there are a few features to consider when making your choice. Always check the minimum requirements you must meet to perform transactions and the fees. Also consider the ease of access. You want an app that you can easily access across your devices.

Other great features to look for include:

- bank account management

- security features

- global access

- growth opportunities

- low-cost money transfers and withdrawals

Can you trust online banks?

The short answer to this is yes, you can trust online banks. Most go the extra mile to ensure your banking experience is safe and secure and your privacy protected.

The first layer is at a national level. Many countries have deposit insurance programs to protect depositors against bank failures.

For example, the Federal Deposit Insurance Corporation (FDIC) is a U.S. government agency created by Congress. It insures deposits, examines and supervises financial institutions for safety, and provides consumer protection.

Canada has the Canada Deposit Insurance Corporation (CDIC), which provides deposit insurance coverage up to $100,000 per depositor per category.

In Europe, the Deposit Guarantee Schemes Directive requires member states to have deposit insurance programs that provide up to €100,000 per depositor per bank.

Other countries with versions of deposit insurance programs include Australia, Brazil, China, Japan, and Russia, among others. Specifics of the programs, such as level of coverage and funding, vary depending on the country and banking system.

In general, online banks are typically subject to the same regulations and oversight as traditional banks. This ensures they operate safely and soundly.

These banks also employ advanced security measures. Things like two-factor authentication, encryption, and fraud detection systems protect people’s sensitive information and prevent unauthorized access.

Of course, it’s always important to do your due diligence and research when choosing a bank.

Related resources

Latest articles

-

How to simplify payment operations with Payoneer’s automation feature

Save time, reduce costs, and eliminate errors with Payoneer’s new payment automation feature.

-

How to prevent online payment fraud as an SMB

Prevent online payment fraud by overcoming challenges like phishing, fake accounts, and account takeovers (ATO) with enhanced security features from Payoneer.

-

Amazon Fees & Policy Updates 2024

Amazon regularly makes planned updates to fees and policies that may impact Payoneer customers that sell on Amazon. To keep Payoneer customers informed regarding upcoming and past updates, we’re providing a list of known changes to Amazon fees and Policy updates.

-

How Payoneer’s target exchange rate feature will help you save more on bank withdrawals

Boost savings with Payoneer’s target exchange rate feature.

-

Navigating phishing attacks: A guide to keeping your Payoneer account secure

Keeping your funds safe is our number one priority at Payoneer. While phishing attempts can happen, arming yourself with knowledge is key to keeping your data and money safe

-

Zoho Books and Payoneer integration guide

Learn how to seamlessly integrate Payoneer with Zoho Books. Follow our step-by-step guide to connect your accounts, create invoices, and manage payments efficiently. Optimize your financial operations today!