HomeResourcesHow to use PayoneerPaying into a Fiscal Representative Bank Account

Paying into a Fiscal Representative Bank Account

If you’re a cross-border eSeller in the EU and UK, you’re likely to use Payoneer’s VAT Service which enables you to easily pay required VAT for free, save on conversion fees and receive peace of mind that your payment will arrive on time. For some, paying VAT in France, Italy, Poland and Spain can be…

If you’re a cross-border eSeller in the EU and UK, you’re likely to use Payoneer’s VAT Service which enables you to easily pay required VAT for free, save on conversion fees and receive peace of mind that your payment will arrive on time.

For some, paying VAT in France, Italy, Poland and Spain can be a complicated process as you need to pay directly to a fiscal representative or through a VAT agent. We now support paying fiscal representatives and VAT agents directly, in which all that needs to be done is to enter their International Bank Account Number (IBAN) into our portal.

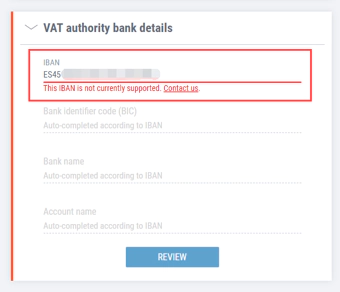

If their IBAN is not yet supported, you’ll receive the following message (see screenshot below).

Requesting a new Fiscal Representative bank account

We can add their bank account into our system manually for you, which typically takes 1-3 business days. Please contact us with the details shown below. Should we need additional information, we will contact you.

- Bank name

- Account name

- IBAN

- BIC

- Link to the fiscal representative site

- Type of account (tax authority/agency)

Ready to start saving? Pay You VAT

Related resources

Latest articles

-

How to simplify payment operations with Payoneer’s automation feature

Save time, reduce costs, and eliminate errors with Payoneer’s new payment automation feature.

-

How to prevent online payment fraud as an SMB

Prevent online payment fraud by overcoming challenges like phishing, fake accounts, and account takeovers (ATO) with enhanced security features from Payoneer.

-

Amazon Fees & Policy Updates 2024

Amazon regularly makes planned updates to fees and policies that may impact Payoneer customers that sell on Amazon. To keep Payoneer customers informed regarding upcoming and past updates, we’re providing a list of known changes to Amazon fees and Policy updates.

-

How Payoneer’s target exchange rate feature will help you save more on bank withdrawals

Boost savings with Payoneer’s target exchange rate feature.

-

Navigating phishing attacks: A guide to keeping your Payoneer account secure

Keeping your funds safe is our number one priority at Payoneer. While phishing attempts can happen, arming yourself with knowledge is key to keeping your data and money safe

-

Zoho Books and Payoneer integration guide

Learn how to seamlessly integrate Payoneer with Zoho Books. Follow our step-by-step guide to connect your accounts, create invoices, and manage payments efficiently. Optimize your financial operations today!