What is liability insurance for Amazon sellers

As an Amazon seller, you may be unaware that Amazon demands you to have up-to-date product liability insurance. While the retail titan isn’t responsible for any mishaps that occur with your products, sellers must protect themselves from potential injuries, mishaps, or legal issues. The good news is that obtaining ecommerce insurance, specifically product liability insurance,…

The importance of liability insurance for Amazon sellers

Editor’s Note: This guest post was written by Scott Letourneau, CEO of NCP and Sales Tax System.

As an Amazon seller, you may be unaware that Amazon demands you to have up-to-date product liability insurance. While the retail titan isn’t responsible for any mishaps that occur with your products, sellers must protect themselves from potential injuries, mishaps, or legal issues. The good news is that obtaining ecommerce insurance, specifically product liability insurance, is not as complicated as one might think.

In this article, we will delve into insurance for Amazon sellers, highlighting the benefits and considerations, and provide guidance on effectively meeting the product liability requirements. We understand the importance of accurate and engaging content tailored to our valued client base. So, let’s dive in and explore the world of liability insurance for Amazon sellers.

As an Amazon seller, you may be unaware that Amazon demands you to have up-to-date product liability insurance. While the retail titan isn’t responsible for any mishaps that occur with your products, sellers must protect themselves from potential injuries, mishaps, or legal issues. The good news is that obtaining ecommerce insurance, specifically product liability insurance, is not as complicated as one might think.

In this article, we will delve into insurance for Amazon sellers, highlighting the benefits and considerations, and provide guidance on effectively meeting the product liability requirements. We understand the importance of accurate and engaging content tailored to our valued client base. So, let’s dive in and explore the world of liability insurance for Amazon sellers.

Why have product liability insurance?

Product liability insurance is a crucial safeguard for your brand, shielding you from legal issues that may arise with customers, due to injury or damage caused by your products. Let’s consider a scenario where a product you sold results in physical harm to the buyer.

In such cases, product liability insurance will cover the medical expenses required to pay for the customer’s treatment. Moreover, this specific insurance also covers legal fees arising from potential lawsuits, ultimately protecting your business from expensive settlements.

It’s worth noting that while not a requirement from Amazon, forming a Limited Liability Company (LLC) can provide additional protection for your brand’s assets. An LLC acts as a safeguard against potential lawsuits, offering peace of mind to Amazon sellers.

Recent lawsuits related to items sold on Amazon have prompted the ecommerce titan to enforce its longstanding insurance requirements for sellers. As part of this effort, Amazon has introduced new elements its insurance policies, aiming to protect both sellers & customers.

Expansion of the A-to-Z guarantee

The A-to-Z Guarantee is a mechanism implemented by Amazon to safeguard customers from order issues encountered with third-party brands. Under this guarantee, Amazon assesses every complaint and works out its eligibility for a refund. The recent expansion of the A-to-Z Guarantee provides additional protection for sellers against sham claims. Let’s take a look:

- Claim Analysis: Once a user files a claim, Amazon diligently analyzes the claim to verify its veracity.

- Mediation Process: Amazon takes charge of the entire claims resolution process, mediating between customers, sellers, and the insurance company for valid claims.

By entrusting the A-to-Z claims process to Amazon, sellers can save time and effort that would otherwise be spent on individual claim assessments. Amazon assumes responsibility for managing the process, ensuring a fair resolution for all parties involved.

Stay compliant with Amazon’s updated insurance requirements

While in the past, Amazon may have taken a relatively lenient approach to enforcing its product liability insurance policy, the landscape has shifted. Effective September 1, 2021, all sellers surpassing $10,000 in monthly sales, regardless of location or business residence, must comply with Amazon’s new liability insurance requirements. This update was introduced as part of the Amazon Insurance Accelerator program, aiming to enhance seller protection within the recently updated A-to-Z guarantee program.

To ensure continued success and compliance as an Amazon seller, it is vital to promptly understand and meet these updated insurance requirements. Doing so can safeguard your brand, protect your assets, and give customers the trust and confidence they deserve.

As an Amazon seller, product liability insurance should be a top priority to protect your brand and guard against potential risks. While Amazon requires sellers to have this type of insurance, the process is more manageable than you might think. By understanding Amazon’s insurance requirements and staying compliant with the latest updates, you can confidently navigate the liability insurance world.

As ecommerce professionals, we understand the importance of providing our clients with accurate and up-to-date information. Our goal is to empower Amazon sellers with the knowledge they need to navigate the complexities of product liability insurance effectively. By partnering with us, you can access a wealth of resources and support to help you meet Amazon’s insurance requirements and protect your business.

Our team at Payoneer is well-versed in the intricacies of liability insurance for Amazon sellers. We work closely with industry experts to ensure our clients receive the most relevant and reliable information. Plus, we continually update our resources to reflect the latest developments and changes in Amazon’s insurance policies.

Regarding liability insurance, it’s vital to stay ahead of the game. Amazon’s recent expansion of the A-to-Z Guarantee (more of this later) and the introduction of stricter insurance requirements signify a market shift. Fortunately, you can proactively address these changes and ensure your business is fully compliant.

We understand that insurance can be complex, but we aim to simplify the process for you. With the help of industry leaders, we are better able to provide the guidance your ecommerce company needs to stay compliant. We are familiar with many leading insurance providers who specialize in serving Amazon sellers, and they can certainly assist you in finding a policy that fits your unique needs.

Moreover, we recognize that insurance is just one aspect of running a successful Amazon business. At Payoneer, we offer a comprehensive services tailored to ecommerce sellers. From seamless cross-border payments to integrated working capital solutions, we’re here to support you every step of the way.

At Payoneer we remain committed to providing Amazon sellers with accurate, engaging, and relevant content on liability insurance. We understand the significance of this topic and its impact on your business.

Contact us today to learn more about how we can assist you in navigating the world of product liability insurance for Amazon sellers.

Source: Amazon Seller Central Payment Information

Introducing Amazon’s enhanced A-to-Z guarantee: Protecting you and your business

We are thrilled to share the exciting news about Amazon’s enhanced A-to-Z Guarantee. This incredible program goes above and beyond to protect customers and sellers, offering peace of mind and a seamless shopping experience.

What does this mean for you as an Amazon seller? Imagine a scenario where a defective product you sold causes property damage or personal injury. With Amazon’s enhanced A-to-Z Guarantee, customers can now file claims for such incidents, and Amazon will directly pay them for claims under $1,000. This is a game-changer because over 80% of cases fall into this category. And the best part? It won’t cost you a penny. Amazon takes care of the costs and pursues the seller separately if needed.

But it doesn’t stop there. Amazon is going the extra mile to make the claims process even smoother. They’ll facilitate the resolution of property damage and personal injury claims between customers, sellers, and their insurance providers. All you need to do is contact Amazon Customer Service, and they’ll notify the seller and assist in addressing the claim. It’s a win-win situation that saves you time, money, and effort.

And that’s not all. Amazon is committed to helping you protect your business with liability insurance. Through their Amazon Insurance Accelerator program, they’ve partnered with trusted insurance providers who offer competitive rates for qualifying sellers. Obtaining the coverage you need is now easier and more affordable than ever. You can rest easy knowing you have the resources and support to keep your business safe and thriving.

With Amazon’s enhanced A-to-Z Guarantee and our partnership, you can focus on what you do best—growing your business—while Amazon protects your customers and supports your success.

Join thousands of sellers who have benefited from Amazon’s commitment to excellence and take advantage of their enhanced A-to-Z Guarantee today. With Payoneer, we can create a brighter future for your e-commerce journey.

Insights on insurance for Amazon sellers – courtesy of Scott Letourneau CEO of NCP and Sales Tax System

We understand that Amazon’s new insurance requirements may seem daunting, but we’re here to help you navigate the process. To provide valuable insights into these requirements, we spoke with Scott Letourneau, CEO of NCP and Sales Tax System, who shared his expertise on what sellers must do to comply with Amazon’s new standards. Let’s dive into the key points and outline the necessary steps for sellers.

- Obtain a Commercial General Liability policy

As part of Amazon’s new requirements, sellers must obtain a Commercial General Liability (CGL) policy with a minimum coverage of $1,000,000. This policy should also include product liability coverage for products/completed operations. It’s crucial to ensure that your insurance coverage aligns with these specifications.

- Opt for an Occurrence Form policy

When selecting an insurance policy, choosing an Occurrence Form policy is essential. This policy provides coverage for incidents that occur during the policy period, regardless of when the claim is filed. It offers comprehensive protection for past and future occurrences, ensuring your business is adequately covered.

- Aim for a company rating of A- or better

To meet Amazon’s requirements, it’s important to have an insurance policy from a provider with a company rating of A- or better. This rating indicates the financial stability and reliability of the insurance company, providing an added layer of trust and security.

- Ensure coverage for all Amazon sales

Your insurance policy should cover all sales from products listed on Amazon. It’s crucial to review the terms and conditions of your policy to confirm that it aligns with Amazon’s requirements. This step ensures that your coverage encompasses all aspects of your business on the platform.

- Add ‘Amazon.com Services LLC’ as additional insured

As part of the insurance requirements, sellers must name ‘Amazon.com Services LLC’ and its affiliates and assignees as additional insured parties. This step ensures that Amazon is protected under your insurance policy in case of any claims or incidents related to your products.

- Verify company name and address alignment

To ensure a seamless process, it’s important to match your company name and address precisely with the information on your Seller Central Account. This alignment helps avoid any discrepancies or delays when uploading the required documentation.

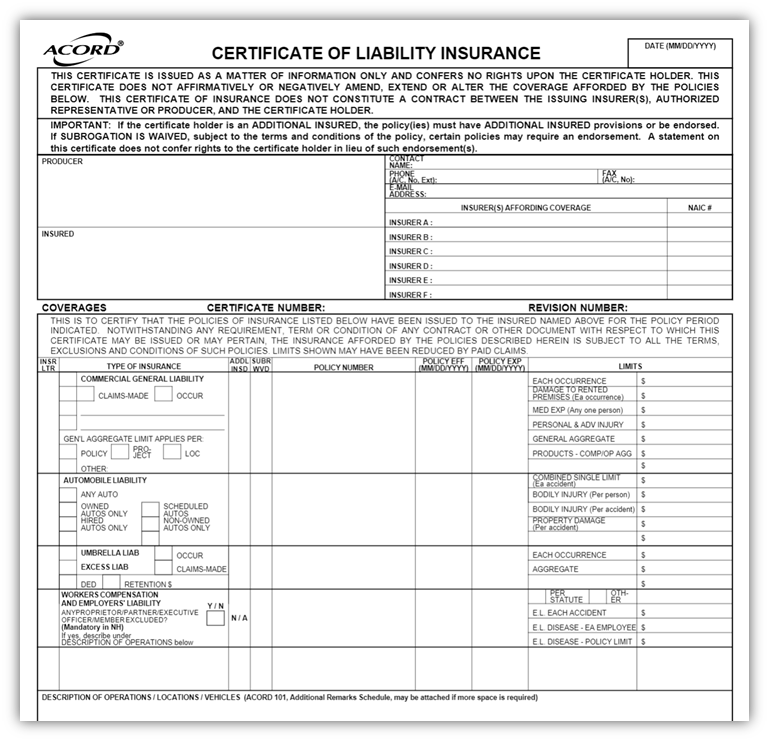

- Upload the Certificate of Insurance (COI)

Finally, sellers must upload the Certificate of Insurance (COI) to their Seller Central account. The COI proves your insurance coverage and demonstrates compliance with Amazon’s requirements. Be sure to follow the guidelines provided by Amazon when uploading the COI to ensure a smooth and successful submission.

Rest assured, when you follow these steps, you can confidently navigate Amazon’s new insurance requirements. As a trusted partner, we are here to support you throughout this process and provide guidance on finding the right insurance provider to meet these standards.

Remember, compliance with Amazon’s insurance requirements not only protects your business but also instills trust and confidence in your customers. Stay ahead and ensure your business is well-prepared to thrive in the ever-evolving e-commerce landscape.

The best insurance for Amazon sellers based in the U.S. and outside of the U.S.

Great news for U.S. sellers on Amazon! Obtaining liability insurance and the Certificate of Insurance (COI) is simpler. To ensure you’re fully covered and meet Amazon’s requirements, work with an insurance company familiar with Amazon and its criteria.

By partnering with an experienced insurance company, you can streamline the process and save time. They understand Amazon’s requirements, such as Commercial General Liability (CGL) with Products Liability coverage, Occurrence Form Policy, coverage for all Amazon sales, and naming ‘Amazon.com Services LLC’ as an additional insured party.

With their expertise, you’ll get the right coverage that aligns with Amazon’s guidelines. They’ll help ensure your company’s name and address match your Seller Central Account and guide you through uploading the COI on the platform.

Simplify the process by choosing an insurance company well-versed in Amazon’s requirements. They’ll navigate the insurance landscape, ensuring your Amazon business is protected and ready for success. With their assistance, you can navigate the insurance process while focusing on growing your business on the world’s largest online marketplace.

A partial example of a Certificate of Insurance (COI).

Non-U.S.-based sellers looking for liability insurance for selling on Amazon.com may need help finding local insurance providers in their country. If you are a seller with an annual turnover exceeding $3 million or deal in high-risk products such as supplements, exercise equipment, or children’s toys, obtaining coverage from a provider in your country can be more challenging.

If you are in this situation, Amazon’s Insurance Accelerator program offers options to address these challenges. Marsh.com is the best option for obtaining a Certificate of Insurance linked to your foreign entity or individual selling on Amazon.com. While Marsh.com plans to expand coverage to more countries, not all countries are included.

If your country does not provide coverage, your alternative is to work with a U.S. insurance provider. We recommend well-insurance.com, as they can provide you with a Certificate of Insurance after establishing a U.S. company, U.S. address, and EIN (Employer Identification Number).

Alternatively, a U.S. LLC is a common option for non-resident sellers without other insurance options.

At NCP, they can provide those services for you so that you can obtain your certificate of insurance for Amazon sellers.

How long does it typically take Amazon sellers to obtain a Certificate of Insurance?

Obtaining a Certificate of Insurance typically takes 2-4 business days, provided you don’t need to establish a U.S. company first.

When working with an insurance provider, one crucial step is ensuring you complete their insurance application accurately and comprehensively. During our conversation with Matt Lovell, the founder of Well Insurance, he assured us that once they receive the application, agree upon the quote, and receive the first payment, they can swiftly obtain the Certificate of Insurance.

In fact, with Well Insurance, this entire process can be completed in as little as 24 hours.

Rest assured that securing the necessary insurance coverage for your Amazon business is a streamlined and efficient process.

With proper completion of the insurance application and collaboration with reputable providers like Well Insurance, you can quickly obtain your Certificate of Insurance and meet Amazon’s requirements.

Non-compliance penalties associated with new insurance for Amazon sellers

What happens if Amazon sellers fail to comply with the new insurance requirements? The enforcement of these requirements, which has been in place for years but not actively enforced, changed significantly as of September 1, 2021.

Insurance is mandatory for sellers generating more than $10k in monthly sales. While we anticipate that Amazon will issue another notice shortly, providing sellers with an additional 30-60 days to achieve compliance, failure to comply after that notice may suspend your Amazon account.

Even if you promptly provide a Certificate of Insurance (COI) following the notice, the duration of the account reactivation process remains to be determined. It could take 24-48 hours or longer.

Amazon sellers must understand the implications of non-compliance with the new insurance requirements. To ensure uninterrupted selling privileges and a smooth account reactivation process, it is essential to meet the insurance obligations set by Amazon proactively.

By adhering to these requirements, you comply with Amazon’s policies and maintain a trustworthy and thriving presence on the platform. Don’t take any chances with non-compliance—act swiftly to secure the necessary insurance coverage and protect your Amazon business.

Amazon FAQs for sellers – how to find assistance

Are you wondering if there is an FAQ area to assist with issues about insurance for Amazon sellers? Rest assured, Amazon has established a dedicated section on its discussion boards to address sellers’ inquiries about its insurance requirements.

When Amazon announced the new policy and programs on August 10, 2021, they set up a special area on the discussion boards to answer sellers’ questions about its insurance requirements. This FAQ section serves as a valuable resource to find answers to any lingering questions you may have.

By exploring Amazon’s FAQ area, you can gain insights and a better understanding of the insurance requirements set by Amazon. It provides comprehensive information to navigate any uncertainties or concerns you may have regarding insurance for Amazon sellers.

Leveraging its FAQ section to take advantage of Amazon’s commitment to seller support. Stay informed, address your questions, and ensure you clearly understand the insurance requirements to meet Amazon’s guidelines for successful selling on the platform.

Steps for resolving name mismatches between insurance and your Amazon account info

What happens if there is a discrepancy between your insured name and the legal entity name on your Amazon account? It’s crucial to address this issue promptly, as it can lead to the suspension of your ecommerce account. To ensure a smooth and compliant experience for liability insurance for Amazon sellers, it’s essential for the following details to align:

- Legal entity name on your certificate of insurance

- Legal entity name on your bank account

- Legal entity name on your Amazon account

- For U.S. taxpayers, the legal name on your EIN should also match

- The legal address should be consistent across all the above-mentioned.

Failure to accurately align these details can cause complications and result in account suspension. To avoid disruptions and maintain the proper insurance for Amazon sellers, it’s vital to ensure that all the necessary names and addresses align precisely.

By ensuring consistency among these key elements, you demonstrate compliance and maintain a steady business presence on Amazon. Take the necessary steps to align your insured name with the legal entity on your Amazon account, ensuring a harmonious and uninterrupted selling experience while adhering to the liability insurance requirements for Amazon sellers.

Possible reasons Amazon isn’t accepting you proof of insurance?

Are you facing hurdles in getting your insurance proof accepted by Amazon? Don’t worry; we’ve got you covered. Here at Payoneer, we bring you valuable expertise from industry leaders like Scott, who has shared his insights on navigating insurance challenges, specifically on Amazon.

In his enlightening guest post, Scott addresses common issues like name mismatches between your Certificate of Insurance and your Amazon account’s legal business name or address.

Key points from Scott:

- Name mismatches: Understand how to align your Certificate of Insurance with your Amazon account details.

- Meeting Amazon’s requirements: Discover how to select an insurance carrier with the necessary “A” rating, ensuring compliance with Amazon’s standards.

- File format compatibility: Learn the accepted formats (PDF, DOCX, or DOC) and avoid complications with photo images.

At Payoneer, we empower ecommerce sellers with the knowledge and tools needed to succeed. Through Scott’s insights, we offer actionable guidance to overcome insurance challenges and thrive on Amazon’s platform.

Unlock Scott’s expert insights on our blog today and elevate your insurance compliance on Amazon. With us by your side, you’ll confidently navigate insurance requirements and achieve greater success in ecommerce.

Adopt Scott’s valuable advice regarding insurance for Amazon sellers and take control of your insurance journey on Amazon. We support you every step of the way – register now and get started on your Amazon ecommerce journey to entrepreneurship!

Scott Letourneau is the CEO of NCP and Sales Tax System. If you need support with a U.S. entity for your Amazon business, reach out to his team at support@launchwithconfidence.com, or click the following link www.LaunchWithConfidence.com

The content provided in this article including any information relating to pricing, fees, and other charges is accurate and valid only as of the date it was published. In addition, changes in applicable regulations, policies, market conditions, or other relevant factors may impact the accuracy of the mentioned pricing and fees and other associated details. Accordingly, it is further clarified that any information regarding pricing, fees and other charges is subject to changes, and it is your responsibility to ensure you are viewing the most up to date content applicable to you. Payoneer will provide the most up to date and accurate information relating to pricing and fees as part of the account registration process. Registered customers can view this information via their online account.

Related resources

Latest articles

-

How to simplify payment operations with Payoneer’s automation feature

Save time, reduce costs, and eliminate errors with Payoneer’s new payment automation feature.

-

How to prevent online payment fraud as an SMB

Prevent online payment fraud by overcoming challenges like phishing, fake accounts, and account takeovers (ATO) with enhanced security features from Payoneer.

-

Amazon Fees & Policy Updates 2024

Amazon regularly makes planned updates to fees and policies that may impact Payoneer customers that sell on Amazon. To keep Payoneer customers informed regarding upcoming and past updates, we’re providing a list of known changes to Amazon fees and Policy updates.

-

How Payoneer’s target exchange rate feature will help you save more on bank withdrawals

Boost savings with Payoneer’s target exchange rate feature.

-

Navigating phishing attacks: A guide to keeping your Payoneer account secure

Keeping your funds safe is our number one priority at Payoneer. While phishing attempts can happen, arming yourself with knowledge is key to keeping your data and money safe

-

Zoho Books and Payoneer integration guide

Learn how to seamlessly integrate Payoneer with Zoho Books. Follow our step-by-step guide to connect your accounts, create invoices, and manage payments efficiently. Optimize your financial operations today!