HomeResourcesGeneral PaymentsAP automation

How to simplify payment operations with Payoneer’s automation feature

Save time, reduce costs, and eliminate errors with Payoneer’s new payment automation feature.

Why payment automation is a game-changer

Managing payments can feel like a full-time job – from receiving invoices to accurately cross-checking details with company orders, setting up payments and meeting deadlines. It’s not just time-consuming but also costly, due to labour expenses and possible human errors.

Now imagine if this entire process could run itself. No errors, no wasted hours, and everything happening like clockwork. That’s exactly what Payoneer’s automated payments feature delivers, with the advantage of managing your payment operations from one single place.

Here’s why automation is more than just a time-saver:

Time back in your hands

Processing payments manually is time-consuming. Automating the process shaves off hours, so you can focus on strategy, not spreadsheets.

Flawless efficiency

Say goodbye to bottlenecks. With streamlined payouts and automated workflows, you’ll boost productivity and maintain smooth operations.

Unmatched accuracy

Minimize errors by automatically inputting payment data from the invoice for precise accuracy every time.

Cost savings made simple

Keep your costs down by reducing labor expenses and additional human errors. That’s extra funds to invest in your business success.

Meet Payoneer’s new automated payment feature

We’ve built this feature to address the challenges of payment management. It’s fast, accurate, and intuitively designed to make paying contractors and suppliers’ bank accounts easier for you and your team.

Consolidated payment management

With Payoneer’s automated feature you no longer need to juggle multiple excel sheets and platforms to handle payments. Manage your payment operations, from capturing invoices to approvals and payouts, all in one place: your Payoneer account.

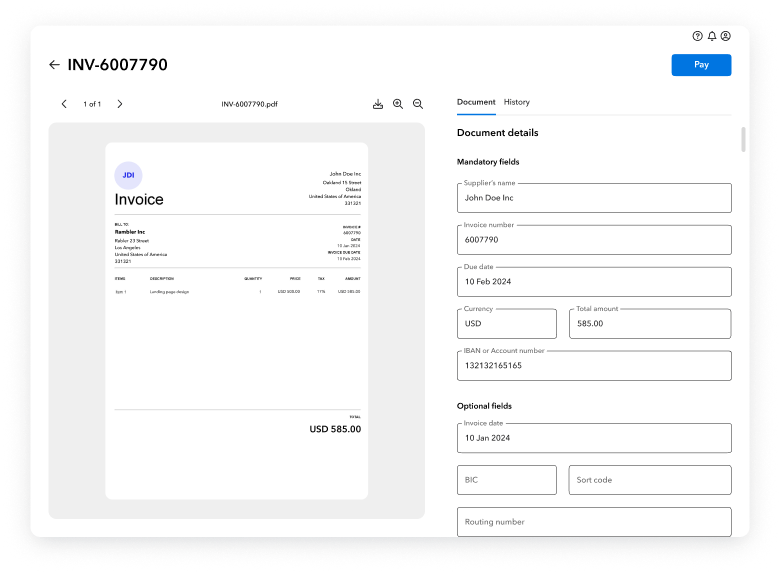

Invoices, simplified

Suppliers and contractors can email their invoices to a unique address provided by Payoneer. Our system scans the file to extract crucial details like the amount, currency, recipient, and payment due date. Or you have the option to manually upload invoices to the payment dashboard.

Efficient approvals

No more manual data entry. Review, edit, and approve invoices right from your Payoneer dashboard. Everything’s already pre-filled and validated for you.

Effortless payments

Once approved, the payment is ready to go. Choose the balance you want to pay from, and if the due date is in the future, the system schedules it automatically.

Real-time tracking

Stay in control with a clear, filterable dashboard. Track every payment and invoice status – whether new, approved, paid, or canceled.

Discover the efficiency of payments automation

How it works

Manage

- Access your dashboard

Go to Pay and select Pay and manage invoices in your Payoneer account. - Add your invoice/s to the dashboard

To automate the billing process, you can either upload the invoice or request that invoices be sent to XXX@invoices.payoneer.com

Review

- Select an invoice

Choose an invoice from your dashboard. - Review the invoice

Check the details and edit any incorrect information and click Pay.

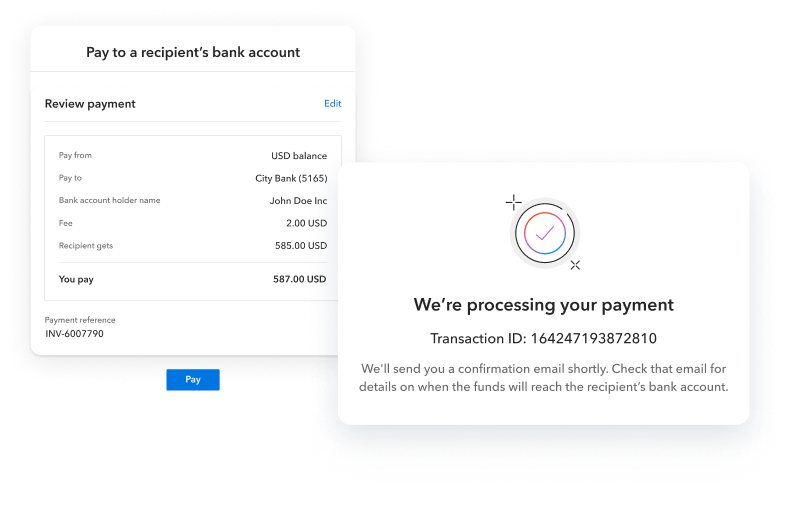

Pay

- Choose balance

Select the balance you’re paying from, then click Next. - Confirm payment

Review payment details and click Pay. - Verify payment

Enter the verification code you receive to complete. That’s it – now* your payment is being processed!

* Payments scheduled for a later date will automatically be sent on the selected date

Final thoughts

Automation isn’t a buzzword – it’s redefining how businesses of all sizes work. By eliminating manual payment tasks, you gain the freedom to focus on what truly drives growth: innovation, strategy, and customer experience.

Payoneer’s new automated payments feature is your partner for smarter, more efficient payment operations. The future of payment management is here – and it’s effortless. Ready to get started? Let Payoneer handle your payments so you can handle growth.

Disclaimer

Nothing herein should be construed as if Payoneer Inc. or its affiliates are soliciting or inviting any person outside the jurisdiction where it operates/is licensed to engage in payment services provided by Payoneer Inc. or its affiliates, unless permitted by applicable laws. Any products/services availability are subject to customer’s eligibility. The availability of this product is not guaranteed and may vary. Not all products/services are available in all jurisdictions in the same manner.

Related resources

Latest articles

-

How to simplify payment operations with Payoneer’s automation feature

Save time, reduce costs, and eliminate errors with Payoneer’s new payment automation feature.

-

How to prevent online payment fraud as an SMB

Prevent online payment fraud by overcoming challenges like phishing, fake accounts, and account takeovers (ATO) with enhanced security features from Payoneer.

-

Amazon Fees & Policy Updates 2024

Amazon regularly makes planned updates to fees and policies that may impact Payoneer customers that sell on Amazon. To keep Payoneer customers informed regarding upcoming and past updates, we’re providing a list of known changes to Amazon fees and Policy updates.

-

How Payoneer’s target exchange rate feature will help you save more on bank withdrawals

Boost savings with Payoneer’s target exchange rate feature.

-

Navigating phishing attacks: A guide to keeping your Payoneer account secure

Keeping your funds safe is our number one priority at Payoneer. While phishing attempts can happen, arming yourself with knowledge is key to keeping your data and money safe

-

Zoho Books and Payoneer integration guide

Learn how to seamlessly integrate Payoneer with Zoho Books. Follow our step-by-step guide to connect your accounts, create invoices, and manage payments efficiently. Optimize your financial operations today!